Confused about the home buying process? Have no idea how much you can afford? Want to make sure you don’t buy a lemon? Let’s review all the steps to buying a house for the first time.

The steps to buying a house for the first time include:

1. Start the process 3-6 months out

2. Find a Realtor

3. Find a mortgage broker

4. Get pre-qualified for a loan

5. Do your own research

6. Find homes online at our below your price range & share with your Realtor so they have a sense of your taste

7. Let your agent and broker guide you through the process

8. Don’t make any big financial changes until after closing

9. Be patient.

I’m not a real estate investor or anything like that.

But in my 53 years on the planet, I have bought and sold my own homes 8 times. Some of those were great decisions and some were not. Let me walk you through the steps every first time home buyer needs to know. Learn from my mistakes as we go!

I also interviewed 2 top-notch Realtors as part of my writing process.

In this post, we’re diving deep into the sometimes confusing world of home buying. I walk you through the entire process from start to finish and take the mystery out of the process and terms.

When we’re done, you’ll know everything you need to know about the steps to buying a house for the first time.

Co-authored with Realtors Bryan Kolasa and Wade Williams

Before we dive in, it’s good to be aware of any issues before you find your dream home.

If you don’t have a current copy of your credit report, then we’re just shooting blindly in trying to raise your credit score.

Luckily, myFICO can get you access to your credit score and a copy of your credit report from all 3 credit bureaus (Equifax, TransUnion, and Experian)!

But myFICO does more than just get you a credit report. With their credit simulator, you can see how possible financial choices will affect your credit score in the future!

Get your 3 bureau report today and save 20%!

Learn more over at myFICO and get started today (just click the link to see all the details on their site).

There are a number of steps to buying a house for the first time to take. We’re going to review them together here. Just be aware of the process from start to finish is not a quick process. Thus it’s always best to be patient.

Don’t be in a hurry and don’t let something like your apartment lease being up in 4 weeks be the driver in this journey (been there and unfortunately done that).

Trying to rush the process can lead to buying a home you aren’t in love with or getting in over your head financially.

What’s the process for buying a house?

First, you need to understand the players involved. There’s:

- Your Real Estate Agent (the person who helps you find a house to buy – they work for you)

- The Real Estate Agent for the Seller (the person who represents the person selling you the house – they work for the seller and most of the time they should not represent both of you)

- Your mortgage broker (the person who arranges your home loan – they work for you and the lender)

- The Loan Company (the company that actually lends you the money – they work for you but are also protecting their own interests)

- The Title Company (the company that handles the legal paperwork – they are neutral)

- The Inspector (the person who comes out to your new home, before you buy it, to inspect it for damages or needed repairs – since you pay them, they work for you but are also supposed to be neutral)

- The Appraiser (the person who comes to the new home before purchase to verify it’s worth at least what you are trying to pay for it – they work mostly for the lender)

All of these people play different, but crucial roles in the steps to buying a house for the first time.

A hiccup with any of them can delay the purchase or even cause it to not happen. Thus it’s really important to choose the right agent!

How do you pick a real estate agent?

A good agent will usually steer you to good brokers, inspectors, etc, so this is the crucial decision.

DON’T just use your cousin who just got their license. And don’t just use the person whose name was on a sign in your neighborhood. Do some research!

Consider the following:

- How many homes did this agent close on last year? (that includes buying and selling, but bear in mind (in my opinion), selling is a better benchmark of their skill)

- How long have they been a Realtor? (new is not necessarily bad and a 25-year track record is not necessarily great – we’ll get into more below)

- How long have they lived in your town/area? (area knowledge of neighborhoods and the market is crucial)

- Assuming they work for an agency, how long have they been with that agency (albeit changing agencies with some degree of frequency is common)

- Have they won any awards?

- Are they part of any national endorsement programs such as Dave Ramsey’s Endorsed Local Provider program? (this provides one additional layer of vetting)

Do I use a hungry new agent or a seasoned pro who has a lot of clients?

There are pros and cons in terms of how long an agent has been working.

The agents I spoke to for researching this, Bryan Kolasa and Wade Williams both had a lot to say! They discussed the plusses and minuses of both brand new agents as well as seasoned long-term agents.

As Bryan put it, “New agents will go the extra mile and get assistance from other knowledgeable agents in their offices, whereas the most experienced agents know their stuff but have less time available.

The middle ground agents have the best of both worlds.”

Do you pay a real estate agent if you are the buyer?

No is the short answer.

While just about anything is negotiable when you submit a contract to buy a house, typically the seller of the home pays the Realtor commission for both their agent and yours.

The average commission on the sale of a home is 6% with the seller’s agent getting 3% and your agent getting 3%.

While that might seem like a lot (3% of a $300,000 home is $9,000), bear in mind most Realtors work for agencies and will split their commission with the agency owner and all the other staff members who assist them.

How do I choose a new home?

Now that you’ve chosen an agent, know that the good news is the home seller pays their commission, so it doesn’t cost you a dime!

Now it’s time to start looking at houses to buy! It’s a bit premature to plan to buy one. But it’s great to get an idea of what’s out there.

The agent will have access to what is called the MLS or multiple listing service. In the old days before Al Gore invented the internet, this was a coveted thing that wasn’t shared with mortal men.

However, in this day and age, a lot (but not all) of what’s in the MLS can be found by anyone on sites like:

There are countless other similar sites, but these 3 are my favorites. Now I’m not for a minute suggesting you don’t need an agent.

But in the old days the only option we homeowners had, other than to rely on our agent, was to literally just drive around and look for yard signs. Or maybe check the newspaper classified ads.

Your agent works for you, but they also may have several other clients.

They may have homes they are the selling agent for which might require them to be meeting inspectors or appraisers. Or they may be holding open houses for hours at a time.

My point is they are busy so it doesn’t hurt to see a little of what’s out there for ourselves.

Plus it will give you a much better idea of home prices and home sizes as well as which neighborhoods are pricier than others. Then you can send some of your favorites to your agent to help them get an idea of what you like.

Have your agent pull the MLS reports on some of your top choices

The MLS can come in handy by showing greater detail on a property’s history.

Maybe the seller has had it on the market 3 different times and it never sold – in which case you need to know WHY!

The MLS can also show properties just listed which may not show up on public sites yet. And those places may not even have hard signs up yet.

My larger point is to help yourself and your agent by having some ideas already of what you want.

Realtor Bryan Kolasa of Madison & Company Properties is quick to point out that “Don’t count on the agent to pick the house for you. The agent is here to help You buy Your house, but not buy their own house.”

After all, no one knows your taste quite as you do!

How long does it take to purchase a house?

For a person who has never bought a house before, I would recommend starting the entire process at least 6 months out. After all, EVERYTHING will be unfamiliar; the terms, the process, the people, and you may also have credit issues that need to be cleaned up.

That being said, 30-60 days is probably more typical.

Most homebuyers take at least a month to find a house they love and put in an offer. In a hot market, your first offer may get outbid, so you may not even get the 1st house you put an offer in on.

That’s why it’s important to not become emotionally attached to just one home. I also like having a list of homes we like with some sort of scoring system so you can rank them.

Once you are under contract on a house, the average time it takes to close is about 30 days on average, but since the crash of 2008, that process does vary more and could take up to 60 days.

Often times (but check with your lender), the first month after you close on a house does not have a mortgage payment (since it was likely covered under the closing costs).

How much money do you need to buy a house for the first time?

After picking a great Realtor, one of the other most important steps to buying a house for the first time is to make sure you aren’t setting your sights too high on home prices.

Trust me, I’ve been there, and being house poor is no fun!

I go much deeper into the topic of How Much Home Can You Afford in another post, so if this is unclear, I highly recommend you take a moment and check that post out.

There are many schools of thought here, but I can tell having bought and/or sold 8 homes that . . .

- You do NOT want to just go by how much the loan officer says you qualify for (they make money by lending you money. The lending company has insurance in case you don’t pay. Thus many loan officers want to lend you as much as possible within reason. In most cases you will almost always qualify for way more than you should be spending).

Don’t believe me? Let me introduce you to 2008. - Take your total monthly household net income and multiply by 25% – This should be about the most you want your monthly payment to be (including taxes and insurance).

In other words, let’s say your household paychecks total $4,500 each month. 25% of that is $1,125.

If taxes and insurance total about $350/month (both will vary a lot depending on where you live) that means your actual loan payment for the home should be about $775.

Interest rates affect this a lot, but at our current low rates, that is about a $150,000 house.

So if your family brings home $4,500/month, you ideally want to buy a house for around $150,000

What are all the different first time home buyer programs available?

There are 8 different types of loans that the first time (or in some cases any) home buyers can apply for through the government’s first time home buyer program.

Here are the 8 different loan types:

- FHA LOAN (a government-issued loan from the Federal Housing Authority)

- FHA 203k LOAN (similar to the above but designed for homes in need of renovation)

- EEM LOAN (a so-called “green” mortgage where you agree to make the home more energy efficient)

- FANNIE MAE and FREDDIE MAC LOANS (a government loan designed to help lower-income families)

- VA LOAN (a government program designed to help veterans)

- NATIVE AMERICAN VETERAN LOANS (As the name implies, this program, similar to the above, helps Native American veterans)

- USDA LOAN (A Department of Agriculture loan for homebuyers purchasing in rural areas) You can enter your property address on the USDA property eligibility map to see if you can qualify for this type of loan.

- GOOD NEIGHBOR NEXT DOOR LOAN (designed by HUD to provide lower-cost loans to police officers, firefighters, EMTs, and teachers)

Of these options, in many cases, the FHA loan will be the way to go.

Your loan officer can review the pros and cons of all that you are eligible for. However, a so-called “conventional loan” (through a private lender and not the government) may get you the best deal whether you are a first time home buyer or not.

Who qualifies for first time homebuyer?

While different lenders will have slightly different policies, for the most part, borrowers need a credit score of 600 or more to qualify for a first time home buyer loan. But they also need to ensure that their debt-to-income ratio isn’t above 50%. FHA loans have a slightly lower credit score requirement of 580.

By debt to income ratio, I mean that the combined total of all monthly debt payments (including the new home loan) won’t exceed 50% of your take-home pay for that same month.

For conventional home loans, you should plan on putting down a minimum of 3% of the home price for your down payment. For Federal Housing Administration (FHA) home loans, if you qualify otherwise, plan on a minimum down payment of 3.5%.

Lastly, for VA loans (current for former military personnel) you can usually get 100% financing, meaning no downpayment is required.

How much money should you save to buy a house?

Generally speaking, if you are buying a home for around $150,000, I would plan on saving AT LEAST $12,000 for a modest down payment, closing costs, and a little set aside for moving expenses and utility transfers.

As we just discussed, most loan programs will require at least 3 or 3.5% downpayment, with the exception of VA loans.

But don’t mistake that for meaning you don’t need to save much money to buy a house. Even with a zero down VA loan, you will still have at least a few thousand in closing costs.

Also, know that the less you put down the more you will owe and the bigger your payment will be.

That being said, as Realtor Wade Williams of Realty Austin points out, “the days of needing 20% down to buy a house are long gone and people’s first mistake in the steps to buying a house for the first time is often thinking they need to save more for their down payment”.

He goes on to say that in a hot market, “you can’t out save in a year’s time the amount of increase in property values”.

In other words, that home you like (or ones similar to it), will have increased more in value (in that year you set aside to save up a larger down payment) than most of us will be able to save.

So it’s A-OK, especially for your first home, to not have 20% and many programs accept as little as 3-5%.

Realtor Bryan Kolasa was quick to point out though, in a hot market with potentially multiple offers “Sellers always going to go with the buyer who has the strongest financial holdings, the best loan, and higher down payment.”

So if you aren’t coming in with a huge down-payment, it may help to make sure all your other financial ducks are in a row.

What are the closing costs for a home buyer?

Closing costs are the legal fees for buying a home that is in addition to whatever downpayment you are making on the new home purchase.

Usually, home buyers will pay between 2% to 5% of the selling price of their home in closing costs.

Why the wide range??

Different states have different laws and regulations, as do different loan lenders. Some closing costs are paid by the seller and some are paid by the buyer, and to a degree, some of those can be negotiated by your Realtors in the contract negotiation phase.

Since some closing costs are simply administrative fees for your lender, it’s important to make sure you use a reputable lender. So when you are shopping around for a lender, don’t just look at the home loan rate, but also ask about fees and closing costs.

If you are buying your home for $198,000 (the US median average home price), your closing costs will likely be the average closing cost of about $7,227, according to data from ValuePenguin.

When you Google about closing costs, you will see some reports that show closing costs at about half that, but those are usually removing prepaid property taxes which still have to be paid at closing.

If your funds are limited, some lenders do offer a no-closing-cost home loan.

Just be aware these typically come with higher interest rates. The lender still gets their money, but you’ll be paying it out over time instead of upfront. Generally speaking, you want your interest rate to be as low as possible (and fixed, not adjustable), so don’t do this unless you know a sizeable raise is coming and you can refinance to a better interest rate in a few years.

What does prequalified for a loan mean?

So now that you know the approximate home price you will be aiming for.

Depending on the market in your area (and by that, I mean how fast stuff is selling) you will (and your agent will guide you here) want to get pre-qualified for a loan before starting to look at houses.

This too is a vital step in the steps to buying a house for the first time.

This means your loan lender will run your credit report. When they run your credit, they will ask you about any potential red flags they see. So if there are any outstanding debts, judgments, old collections, or excessive late payments on other credit cards or debt payments, be prepared to explain them.

In most cases, you will have to fill out a form or letter explaining the issue. Too many of those kinds of issues could cause you to not get approved. But they also will affect your interest rate if you do get approved.

But you want to know NOW if you can’t get the loan or will have to pay a high-interest rate (which will raise your payment) rather than at the end of the process.

Knowing that you are pre-qualified also gives the prospective home sellers some peace of mind when considering your offer.

It also makes it much more likely that you won’t get turned down when you apply for the actual loan. Say they get 2 offers around the same time for roughly the same amount.

If one is pre-qualified, with no other mitigating circumstances, they would definitely pick the pre-qualified one.

What credit score do you need to buy a house for the first time?

As I mentioned above, 580 for FHA loans or 600 for conventional loans is the minimum credit score you will need to get a home loan in most cases.

If you don’t know your credit score and haven’t picked a lender yet (who will tell you your credit score), it may be worth pausing this process to do a little work on your credit score.

I have a very thorough post about some crucial DIY Credit Report Repair steps you can take. Here I walk you through the process of improving your score. You don’t need to hire anyone and it doesn’t have to cost you a thing!

Your agent probably knows one or more mortgage brokers that they have worked with and that’s a great place to start. I would not, however, just blindly go with who they suggest.

Do a little research here as interest rates do vary and over 15 or especially 30 years, a half a percentage difference on an interest rate adds up!

What is the best type of home loan to get?

The 30-year mortgage is the king in the US in terms of loan types.

That being said, when we buy a $200,000 house and spread out the payments over 30 years, we pay an insane amount of interest!

To be specific, a $200k house at 4% interest will cost you a total of $343,738! (factored using MoneyChimp‘s mortgage calculator)

In other words, you pay almost $144,000 in interest over the price of the house just for the privilege of spreading the payments out over 30 years!

Thus one of the other vital steps to buying a house for the first time is making sure you get a great loan rate and term length.

Is a 15-year mortgage worth it?

I always recommend doing a 15-year mortgage over a 30. But while it doesn’t double your payment, it does increase it a little.

Using that same mortgage calculator, the monthly payment difference on that $200,000 house between a 30-year mortgage and 15-year is $524.55.

And the interest you pay over the 15 years is only $66,288!

So by doing the 15-year mortgage, you’ll not only have a paid-for house in 15 years, but you will have saved almost $78,000!

That being said, there are times where it might make sense to take a 30.

Such as if you know you’re getting a sizeable pay increase soon, but the home market is so hot you don’t want to miss out on today’s prices.

If that’s the boat you find yourself in, just know you can Pay a 30 Year Mortgage like a 15 Year (click to read my article).

So once you get that raise, save yourself big bucks over the life of your loan by following my steps in that post!

Which home loan is better fixed or floating?

Thankfully after the crash in 2008, many lenders have cut back on pushing all the loan programs that helped fuel that crash.

The only type of loan you want is a fixed-rate mortgage. But let’s review why.

An adjustable-rate mortgage or floating rate mortgage is just what it sounds like. The interest rate can (and most likely will) adjust after a set amount of time (often 5 to 7 years).

How much it adjusts will be in the written agreement and would be based on the prime rate (a benchmark interest rate banks use that is closely tied to the Federal Reserve funds rate).

Let’s say, for example, you bought that $200k home I mentioned above.

And the interest rate started at 4%. Your monthly payment (putting aside down payment, taxes, and insurance for purposes of this example), would be $954.83 doing the 30-year loan.

However, let’s say you got an adjustable-rate mortgage that adjusts at year 5. And let’s say that it adjusts up 2% to 6%. Your new monthly payment is now $1,199.10.

That’s a difference of almost $250.00 a month! And what if it adjusts that same amount the year after?

My point is it’s totally out of your control!

You’re banking on interest rates staying low which is totally out of your control. Give yourself the peace of mind that comes with a fixed rate that stays the same over your entire loan!

Should I use an online mortgage lender?

Both agents I spoke to for researching this post, Wade Williams and Bryan Kolasa, warned of the dangers of online mortgage companies.

I have gone that route once and it went relatively smoothly.

I’ve also personally gone the big bank route too and seen both success and nightmares. So bear in mind that no one path is fool-proof.

However, as Wade points out regarding online mortgage companies, “local mortgage brokers know all the people involved, know that a smooth transaction means repeat referrals. Generally, everybody has everyone’s best interests at heart”.

Whereas online companies are just making money off the number of applications. Thus they don’t necessarily benefit from fostering good working relationships with anyone.

Bryan echoed a similar sentiment when he said: “(local) professionals have your best interests at heart because they want your future business and referrals.”

Crucial mortgage lender terms you should know

- PITI (stands for Principal, Interest, Taxes & Insurance)

- Principal – the loan amount you are borrowing (or late, the loan amount balance)

- Interest – the profit you agree to pay the lender on top of the principal (the longer the loan period the more you pay)

- Interest Rate – the percentage of the principal you agree to pay (these days it’s typically well under 5% but it has varied wildly over the years)

- Points – A one-time extra profit payment to the lender, often done to get a lower interest rate. This is represented as a percentage, so if you see 1.5 points, that means 1.5% (of the principal). If you can get a low rate with no points; even better!

So you know the market, have an agent, are connected with a mortgage broker, and got pre-qualified.

What to check before buying a house?

One of the things you’ll get in looking at houses is something called a “Seller’s Disclosure“.

This is an important document in the steps to buying a house for the first time! It details everything the seller knows about their house including defects not readily visible.

Let’s say the seller know the foundation was faulty (which you wouldn’t know unless there were major cracks in the foundation or walls).

And if they haven’t fixed it and they don’t put it on the seller’s disclosure, you can sue them after you purchase the home in the event the foundation fails.

This document can also steer you away from properties that might need too much repair in the near future (useful if you are at the top end of your budget for your mortgage payment).

While legal requirements for Seller’s Disclosure can vary by state, this guy nicely sums up some of the most important things to look and ask for.

Depending on the market in your town, if properties have short DOM (days on market) it may be wise to have more than one home that fits your needs. DOM means how many days (on average) homes are taking to sell.

After all, you may find yourself in multiple bidder situations (where more than one buyer puts in an offer around the same time). This often results in some back and forth bartering, all of which can drive the price of your would-be home up!

It’s also wise to not fall completely in love with a house lest you not get it. Do find a home that meets your needs, but recognize that there’s another one on every block.

When you get too emotionally attached, that’s when we can make dumb financial decisions and end up with more home than we can afford.

Thus patience and flexibility play important roles in the steps to buying a house for the first time.

How much should I offer on a home?

The next step is to put in an offer on a property and go through the negotiation stages and hope your offer gets accepted.

The offer process, especially in a hot market, can be tricky.

Offer at or below asking price and you stand a good chance of being rejected or being outbid. Go too high and you’re just wasting money.

But it also increases the odds you’ll get that dream house your spouse can’t live without. This is where a great agent, knowledgeable in your market, really earns their keep!

As Realtor Wade Williams points out “You need a good agent to judge what a place will really sell for. As in a hot market, the selling price they will accept is not necessarily what the listing price is. And some agents intentionally put the selling price low to create a bidding war.”

As I’ve mentioned elsewhere, you want your total monthly house payment, including taxes and insurance, to be about 25% of your take-home pay. So if you make just under $5,000/month in income, you should be looking at and putting offers in on homes around $150,000.

What does being under contract for a house mean?

Once you are under contract then the pressure is off a little bit.

Also, understand in a hot market, this could easily be the 2nd or 3rd house you bid on. The countdown down to the closing date specified and agreed to on the contract draws near. Thus you’re now towards the end of the steps to buying a house for the first time!

Traditionally contracts were often done with a 30-day closing date.

However, after the turmoil in 2008 and changes to lending practices, there is less of a set standard now. But often it would be 30-45 days unless the house is vacant and the buyer is prepared to pay in cash.

As Wade Williams points out, “this is also a good time to check-in (with either your mortgage broker and/or the title company or even your agent) about an estimate of money needed at closing”. While they should be informing you too, you aren’t their only client so it’s “OK to ask and to re-confirm often.”

That way there’s . . . NO SURPRISES AT CLOSING!

Surprises are fun–unless they happen at a #realestate closing. Here’s how to deal: https://t.co/huQR3IxNrv pic.twitter.com/VzEmRTrIn0

— 5 Arch Funding Corp. (@5archfunding) August 25, 2016

What are the final steps in buying a home?

1. The property inspection

- The inspection is done to ensure the home doesn’t have any hidden defects or damage not readily visible

- This is one of the most crucial steps to buying a house for the first time!

- Generally speaking, your agent will typically recommend an inspector and can set up the inspection and handle meeting them at the property (useful since you don’t have the keys yet). You would typically pay for this at the time of the inspection and while I wouldn’t follow the inspector around like a lost puppy, it’s ok for you to be there and ask questions.

- Bear in mind a good inspector will always find 2 or 3 pages worth of so-called “issues” even in a newer home

- It’s important to realize that many of the things noted on the report have to be noted for legal reasons but aren’t necessarily serious and rarely would be a good cause to break the contract

- A good agent can guide you through the report and let you know what you should request the seller fix before closing (or in some cases, it may make more sense to buy as-is for a reduced selling price)

2. The property appraisal

- This is done almost exclusively to ensure the property is worth at least what the lender is loaning you to buy it.

- Your agent or the title company will set this up and you don’t need to be there for this.

- Typically this would be paid at closing (closing is the last step in the process where you and the seller meet at the title company (sometimes together but often separately) to sign all the documents, transfer cash and get the keys and things like garage door openers

- If the appraised value comes back below the agreed-upon selling price then typically the buyer would need to come up with the difference out of pocket, the seller would need to reduce the selling price or both would meet in the middle

- Generally speaking, you would not want to pay significantly above an appraised value for a house unless there were good justifiable reasons (and bear in mind the “appraised” value is based on what other similar properties have recently sold for – not what the county says the value is in tax records (which is often, but not always, a fair amount lower)

3. The property survey

- Basically an architectural rendering of the house and land with complete dimensions to ensure it is exactly what the seller claims it to be

- The title company will request this with no action needed on your part. If the seller has a recent one, a new one may not be needed.

4. The mortgage being underwritten (basically finalized and approved)

- Potentially one of the more tiresome tasks in the home buying process as the lender requires a LOT of documentation from the buyers in order to finalize the loan. Things like:

- Tax Returns for the past 2 years

- 2 months of bank and retirement statements

- 2 or 3 most recent pay-stubs

- Potentially more depending upon the nature of your employment, the loan type, and other factors

- Give a written explanation for any large amount of cash in your bank accounts that didn’t come from employment checks

- In this process, it’s not uncommon for delays to happen, for them to request documents and then later request more, so it pays to be patient and expect delays.

Can a house under contract be sold to someone else?

Yes is the short answer as it happened to my wife and me last year.

But, in most cases, it isn’t likely to happen. In our case, we had a house to sell also, so our offer on the new home we wanted to buy was “contingent”. A contingency simply means the new home purchase can’t be finalized until the existing home we are selling sells.

Usually, contracts have a set amount of time in which the prospective buyer (that was us) sells the home they are trying to sell. If that date passes and we haven’t sold it (or at least gotten it under contract to sell), then the seller of the new home can either cancel the contract or extend it.

However, because the contract was contingent, it gives sellers a loophole to sell to another buyer at ANY time.

In truth, a lot of buyers aren’t likely to want to look at a home that’s under contract, but they can. And if they see one they love that is contingent, if they don’t have a contingency themselves, there’s nothing to prevent them from making an offer (usually a higher offer than yours to entice the seller).

And there’s nothing to prevent the buyer from taking that offer and canceling yours. But if you don’t have a contingency, you really don’t have much to worry about.

What should you not do before buying a house?

Before you start the process of even looking for agents and lenders, you’ll want to avoid any financial reg flag moves such as:

- Being late on paying credit cards or loan payments

- Avoid skipping or getting behind on loan payments

- Don’t change jobs

- Avoid changing banks

Then, after you get under contract on a new home purchase, it’s vitally important for you to NOT:

- Open new any lines of credit (no new credit cards, debt consolidations, loans, etc)

- Make any large purchases (keep it under $500, even if you pay cash)

- Large bank transfers (large amounts of cash in or out of any of your bank accounts, cash out stock, etc.)

If a family member wants to celebrate your success with a big check, wait until after closing to deposit it.

The mortgage company is basically vetting your financial stability and ability to repay this loan on time and consistently.

Thus, INCONSISTENT financial behavior can be seen as a red flag. Need a new car or a new fridge? It can wait until the day after you close!

DO NOT MAKE ANY LARGE PURCHASES UNTIL YOU CLOSE ON YOUR HOME. #loanoriginator #mortgage #love #clients #closings pic.twitter.com/tIFEVwtQqU

— Stacey Sams (@staceymsams) November 4, 2016

Can I move into a house before closing?

Yes is the short answer as my wife and I just did that last year.

Sometimes when selling the house we are currently living in, we might find ourselves needing to move out of where we currently live before we can move into the new place.

If possible, try and get an extension from the people buying your old place or from your current landlord.

But say that’s not possible.

One common scenario would be for you to move into your new home early by technically “renting” it from the people selling it to you.

As long as there are no red flags in the closing process and the seller is already out of the house, that will usually be just fine by all parties.

The amount of the “rent” in this scenario would typically be very small; unless we’re talking about an unusually long period of time.

Of course if you’re in the Atlanta area and need help moving, there’s no better company than Atlanta Home Movers. Find out why virtually all of their customers give them 5-star reviews over at: https://www.atlantahomemovers.com/

What happens at closing when buying a house?

Here you can expect to sign your name so much your hand cramps! It’s also good to make sure you have set aside at least 45 minutes for this process.

This is done at the office of the title company with the title company officers. Often the seller would do their signing at a different time.

Thus most of the time the buyer and seller never actually meet.

While your agent’s work is now done, they often will be here for this process to close out your time working together.

This is also where you will:

- Get the keys to your new home, along with any alarm codes, garage door openers, etc.

- Sign all of the legal documents to officially make the home yours

- Make or receive any payments pertaining to the sale of the home (which as they will tell you in advance so you can get a cashier’s check from your bank in the exact amount)

So I know I’ve covered a lot of detail here about the steps to buying a house for the first time.

So let me boil down everything to those . . .

9 Key Steps to Buying a House for the First Time You Must Know

- START THE PROCESS AT LEAST 3-6 MONTHS OUT: Doing this right is not a rush job and the more time you give yourself the better

- FIND A GREAT REAL ESTATE AGENT

- FIND A LOCAL MORTGAGE BROKER

- GET PREQUALIFIED – That way when you do find your dream house you can jump on it!

- DO YOUR OWN RESEARCH – Help your agent help you

- LOOK AT HOMES AT OR UNDER YOUR PRICE RANGE – Being house-poor is no fun!

- LISTEN TO YOUR REALTOR – They are the expert and they can guide you around pitfalls

- DON’T MAKE ANY BIG FINANCIAL CHANGES DURING THE PROCESS

- BE PATIENT – Expect delays, expect surprises and be pleasantly surprised when they don’t happen and prepared when they do

Realtor Wade Williams says it very succinctly! “If you think you’re ready, go for it! Homeownership is one of the best financial decisions you can make for financial freedom. Don’t wait – if it feels smart, do it!”

What do I need to buy a house checklist

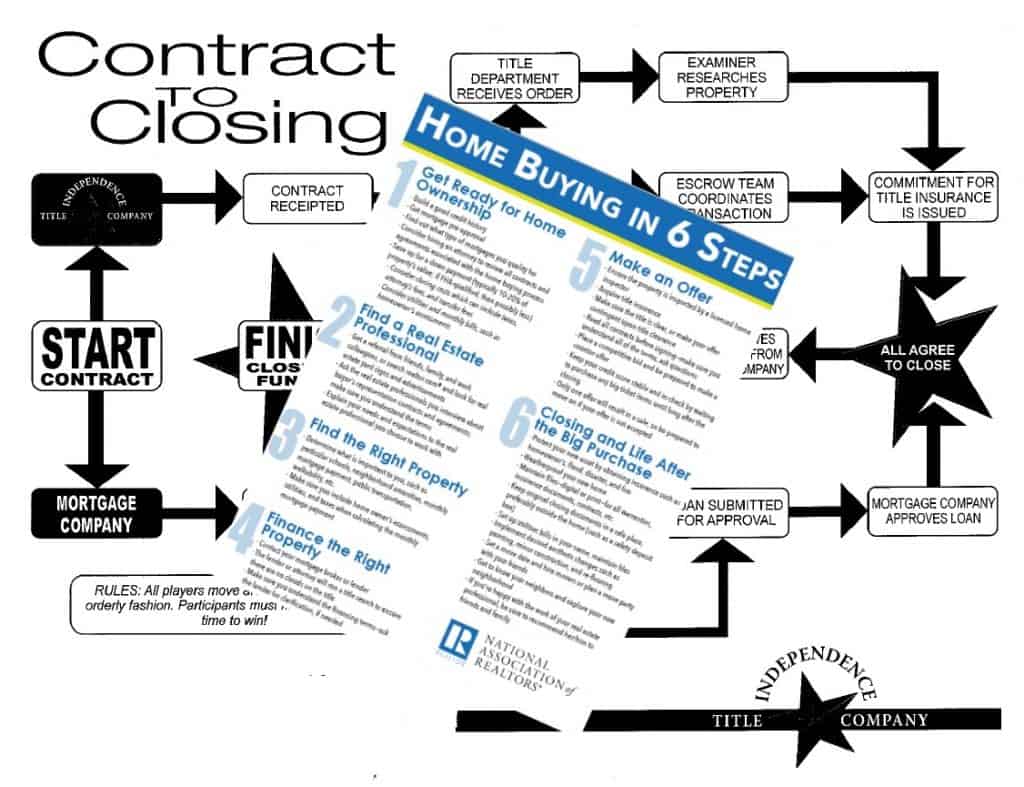

Realtor Bryan Kolasa has generously provided my readers with 2 key home buying checklists he provides all his prospective buyers. They are key to understanding the steps to buying a house for the first time.

Just click the image to get your high-resolution copies at no charge!

Did I cover all the steps to buying a house for the first time you were looking for?

In this post, we took an extensive look at the sometimes confusing process of buying a home.

There are a lot of steps and players involved in buying a house and we broke each of them down in simple, easy to understand language.

Specifically, we looked at all the crucial steps to buying a house for the first time you need to know so you can decide if and when you’re ready.

What is your biggest concern about the home buying process?

If you like this post, please follow my Real Estate & Mortgage board on Pinterest for more great tips from myself and top finance experts!

Before you get started, it’s good to be aware of any issues before you find your dream home.

If you don’t have a current copy of your credit report, then we’re just shooting blindly in trying to raise your credit score.

Luckily, myFICO can get you access to your credit score and a copy of your credit report from all 3 credit bureaus (Equifax, TransUnion, and Experian)!

But myFICO does more than just get you a credit report. With their credit simulator, you can see how possible financial choices will affect your credit score in the future!

Get your 3 bureau report today and save 20%!

Learn more over at myFICO and get started today (just click the link to see all the details on their site).

Photo credits (that aren’t mine):

Image by Oberholster Venita from Pixabay and Image by Gerd Altmann from Pixabay

Sold sign – https://www.flickr.com/photos/marcel-world/

Sale Pending Sign – https://www.flickr.com/photos/danmoyle/

Money Pile – https://www.flickr.com/photos/aresauburnphotos/

Upside down House – https://www.flickr.com/photos/backkratze/

While I have years of successful financial & budgeting experience and run several million-dollar businesses and handled the accounting, P&L, and been responsible for the financial assets of them, I am not a Realtor or mortgage broker which is why I wrote this post in conjunction with 2 licensed Realtors. Like all my posts, my posts are my opinions based on my own experience, observations, research, and mistakes. While I believe all my personal finance posts to be thorough, accurate, and well-researched, if you need financial advice, you should seek out a qualified professional in your area.